online bill pay platform

online bill pay platform

Blog Article

The Future of Finance: Exploring Digital Payment Solutions

In today’s fast-paced, tech-driven world, the way we handle money has transformed dramatically. From cash to cards and now to digital solutions, finance-related tools like digital wallet, mobile payment apps, and fintech platforms are reshaping how we manage transactions. These innovations offer convenience, speed, and security, making them indispensable for individuals, businesses, and merchants alike. Let’s dive into the world of modern financial solutions and explore how they’re revolutionizing the way we pay, transfer, and manage money.

The Rise of Digital Wallets and Mobile Payment Apps

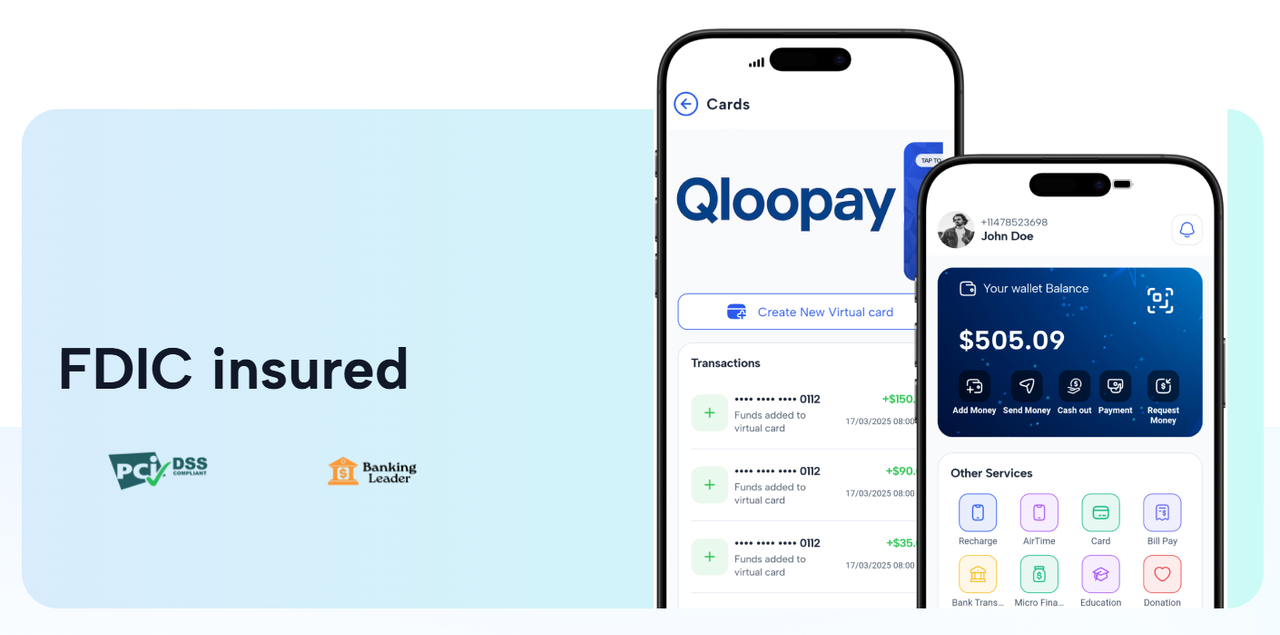

A digital wallet is a virtual storage system that allows users to store payment information securely and make transactions with ease. Paired with a mobile payment app, it turns your smartphone into a powerful financial tool. Whether you’re paying for groceries, splitting a bill with friends, or shopping online, these apps streamline the process. Popular platforms like PayPal, Venmo, and Google Pay have made sending money online or paying at a store as simple as a few taps.

The beauty of a mobile wallet solution lies in its accessibility. With a smartphone, you can make online bill payment or secure money transfers anytime, anywhere. No need to carry cash or cards—just your phone. These apps often use advanced encryption and biometric authentication, ensuring your transactions are safe and secure.

Fintech Platforms: The Backbone of Modern Finance

At the heart of this financial revolution are fintech platform, which integrate technology to enhance financial services. These platforms go beyond simple payments, offering tools for budgeting, investing, and even lending. For example, apps like Chime or Revolut combine mobile wallet solutions with features like real-time spending alerts and savings tools, empowering users to take control of their finances.

Fintech platforms are also making waves in merchant payment platforms, enabling businesses to accept payments seamlessly. Whether it’s a small coffee shop or an e-commerce giant, these platforms provide scalable solutions for processing payments, managing invoices, and even offering customer loyalty programs.

QR Code Payments: Fast, Contactless, and Convenient

One of the most exciting innovations in the financial space is QR code payment. By scanning a QR code with a mobile payment app, customers can instantly pay merchants without physical contact. This method has gained popularity in restaurants, retail stores, and even street markets. It’s fast, reduces the need for cash handling, and enhances security by minimizing card exposure.

For merchants, QR code payments integrate easily into merchant payment platforms, offering a cost-effective way to process transactions. Customers love the simplicity, while businesses benefit from quicker checkouts and lower transaction fees compared to traditional card payments.

Secure Money Transfers and Online Bill Payments

The ability to send money online has transformed how we share funds with friends, family, or businesses. Whether you’re paying rent, settling a group dinner bill, or sending money abroad, secure money transfer services ensure your funds reach their destination safely. Apps like Wise and Zelle prioritize security with features like two-factor authentication and end-to-end encryption.

Similarly, online bill payment has become a game-changer. Instead of writing checks or visiting utility offices, you can pay your bills directly through a digital wallet or fintech platform. Many apps allow you to schedule recurring payments, ensuring you never miss a due date.

Agent Banking Apps: Bridging the Gap for the Unbanked

In regions where traditional banking is less accessible, agent banking apps are making a significant impact. These apps allow local agents to act as intermediaries, helping users deposit, withdraw, or transfer money using a mobile wallet solution. This is particularly valuable in rural areas, where access to banks or ATMs may be limited.

By leveraging agent banking apps, fintech companies are bringing financial inclusion to millions, enabling people to participate in the digital economy. These apps often integrate QR code payments and secure money transfer features, making them versatile tools for both agents and customers.

Why These Tools Matter

The shift toward digital finance isn’t just about convenience—it’s about empowerment. Digital wallets, mobile payment apps, and fintech platforms give users greater control over their money. They make transactions faster, safer, and more accessible, while QR code payments and merchant payment platform help businesses thrive in a competitive market. Meanwhile, agent banking apps are closing the gap for underserved communities, ensuring everyone has a chance to benefit from modern financial tools.

As technology continues to evolve, we can expect even more innovative solutions to emerge. From blockchain-based payments to AI-driven budgeting tools, the future of finance is bright—and it’s all at our fingertips.

Final Thoughts

Whether you’re using a mobile payment app to grab coffee, a fintech platform to manage your investments, or an agent banking app to access financial services, these tools are transforming the way we interact with money. Embracing these solutions means embracing a future where financial freedom is just a tap away. So, why not explore a digital wallet or try a QR code payment today? Your wallet—and your future self—will thank you.

Report this page